Building Resilience and Growth Through Strategic Asset Allocation

For investors considering how to invest, navigating the intricacies of global markets and how much capital to allocate to individual companies can be a difficult decision. One of the most powerful tools available to help mitigate risk and optimise returns is portfolio diversification. The section below explores why diversification is a crucial concept when devising an investment strategy and how this concept is utilised by investment companies such as HarbourVest Global Private Equity (“HVPE”) when constructing a portfolio.

Understanding Portfolio Diversification

At its core, portfolio diversification is the practice of spreading investments across a range of assets, sectors, and geographies. Rather than concentrating all capital in a single investment or asset class, diversification involves constructing a portfolio that contains a mix of different individual investments and asset classes such as private equity, real estate, infrastructure, and private credit. The rationale is straightforward: by holding a diverse array of investments, the overall portfolio is less exposed to the adverse effects of a single underperforming asset.

The Essence of Diversification

Globally diverse portfolios can provide a buffer against economic shocks in specific regions or sectors. Economic cycles, political climates, and market sentiment can vary significantly across global markets, and diversification helps smooth out returns over time. For example, while one country’s market may experience a downturn, another’s may flourish, balancing the overall portfolio performance.

Diversification helps smooth returns during times of market volatility. Rather than seeking to avoid risk entirely, a near-impossible feat, diversification aims to manage it. By holding assets that react differently to the same economic event, investors can reduce the magnitude of potential losses.

Why Diversification Works

The benefits of diversification are grounded in the principle of uncorrelated returns. Different asset classes and markets often have low or negative correlations with each other. This means that when one sector or region underperforms, others may remain stable or even outperform. Building a diversified portfolio helps enhance an investment’s overall risk/return profile.

- Risk Reduction: By spreading investments, the risk associated with a single asset, country or sector is diluted. This reduces the potential for a significant loss, which could occur if an investor had a concentrated position in a failing asset.

- Potential for Smoother Returns: Diversification helps to smooth the volatility of portfolio returns. While individual assets may experience significant price swings, a diversified portfolio is less likely to be severely affected by a single event.

Diversified portfolios are better positioned to weather unexpected events, from global pandemics to geopolitical tensions. Historical data shows that diversified portfolios not only experience lower volatility but also tend to recover faster from market downturns1.

Dimensions of Diversification

Portfolio diversification operates across three main dimensions across the wider investment landscape:

- Asset Class: Choosing a mix of assets classes such as public equities, bonds, private equity, real assets, and cash.

- Geographical Exposure: Investing across developed and emerging markets.

- Investment Style: Combining growth and value strategies, different management styles, and time horizons.

Investment companies like HVPE embrace these dimensions, constructing portfolios that are resilient and nimble in the face of changing market dynamics.

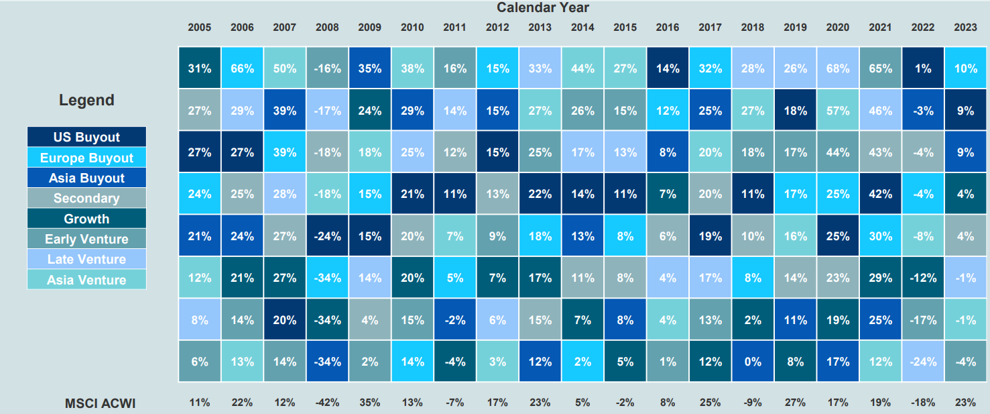

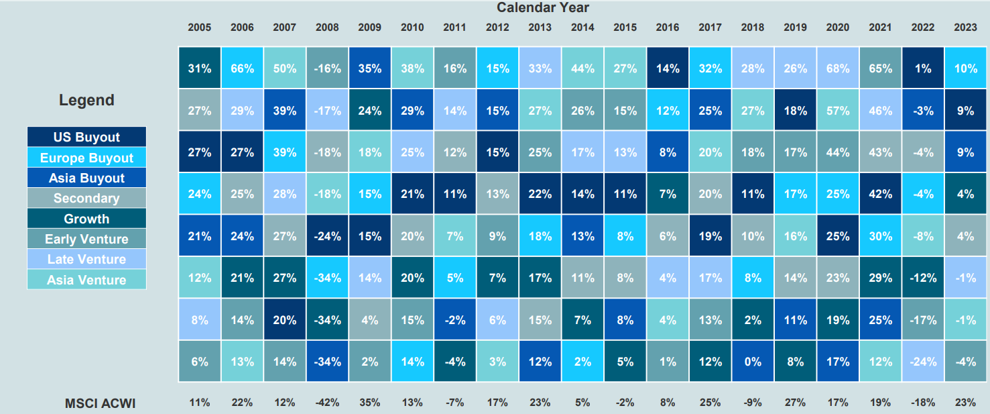

The importance of portfolio diversification can be illustrated by looking at the ti by calendar year for major private equity categories in the table below. The data shows clear rotation between strength of performance of asset classes on an annual basis. A portfolio that is diversified by strategy and geography would be required in order to benefit from the strongest performing asset classes in each year. Conversely, a portfolio that was concentrated in just one of the categories below would see significant year-on-year fluctuations.

Note: MSCI All Country World Index annual return as of the year indicated.

Source: MSCI Private Capital Solutions net LP pooled returns as of December 31, 2023, S&P Capital IQ. Past performance is not a reliable indicator of future results.

HVPE: Portfolio Diversification in Practice

HVPE provides investors with access to a diversified global portfolio of high-quality private equity investments offering investors several key advantages:

- Individual Company Diversification: The HVPE portfolio contains over 1,000 underlying material company exposures with the largest individual company making up just 2.2% of the portfolio’s value2. This low individual asset concentration compares favourably to public market indices. For example, over one third of the S&P 500 is concentrated in the “Magnificent 7” stocks3.

- Geographical Breadth: HVPE invests in North America, Europe, Asia, and other global markets, helping to reduce dependence on any single region’s economy.

- Sectoral Spread: The portfolio covers a range of industries, from technology and healthcare to consumer goods and industrials, ensuring that the impact of sector-specific downturns is partially mitigated.

- Stage and Strategy Diversity: Within private markets, HVPE allocates to venture capital, buyouts, growth equity, and more, capturing opportunities at multiple stages of the business lifecycle.

- Manager Selection: By investing with a variety of private equity managers, HVPE further mitigates the risk of underperformance from any single manager or strategy.

Further information on the diversification of HVPE’s portfolio by its largest 25 underlying companies can be found here: Top 25 Company Exposures | HVPE

Further information on the diversification of HVPE’s portfolio by geography, sector and stage can be found here: Portfolio Diversification | HVPE

Challenges and Considerations

While diversification brings many benefits, it is not without challenges. Over-diversification, i.e. holding too many similar investments, can dilute returns without proportionally reducing risk. Investors must also be wary of hidden correlations, where assets thought to be uncorrelated react similarly during extreme market conditions. Ongoing monitoring and periodic rebalancing are essential to ensure that a portfolio remains truly diversified.

Conclusion

Diversification is a key tool in helping build robust and resilient portfolios. For investors in investment companies like HVPE, diversification offers a pathway to harness global growth, reduce risk, and potentially smooth returns.

As markets evolve and new challenges arise, the principles of diversification remain as relevant as ever, offering investors both peace of mind and the potential for more stable long-term growth.

Footnotes:

1 “The Value of Diversification” Paolo Sodini and Luis M. Viceira, January 2020

2 HVPE company data as per 31 January 2025 Annual Report

3 As of 30 June 2024, data taken from FactSet.com

Note: The value of any investment made in the shares of HVPE and the income from any such investment can go down as well as up, and the investor may not get back the full amount invested. Past performance cannot be relied on as a guide to future performance.

Note 2: MSCI Private Capital Solutions (f.k.a. Burgiss Private Index Data) (unless otherwise indicated) reflects the fees, carried interest, and other expenses of the funds included in the benchmark. Please note that Fund returns would be reduced by the fees, carried interest, and other expenses borne by investors in the Fund. Such fees, carried interest, and other expenses may be higher or lower than those of the funds included in the benchmark. Certain information contained herein (the “Information”) is sourced from/copyright of MSCI Inc., MSCI ESG Research LLC, or their affiliates (“MSCI”), or information providers (together the “MSCI Parties”) and may have been used to calculate scores, signals, or other indicators. The Information is for internal use only and may not be reproduced or disseminated in whole or part without prior written permission. The Information may not be used for, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product, trading strategy, or index, nor should it be taken as an indication or guarantee of any future performance. Some funds may be based on or linked to MSCI indexes, and MSCI may be compensated based on the fund’s assets under management or other measures. MSCI has established an information barrier between index research and certain Information. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. The Information is provided “as is” and the user assumes the entire risk of any use it may make or permit to be made of the Information. No MSCI Party warrants or guarantees the originality, accuracy and/or completeness of the Information and each expressly disclaims all express or implied warranties. No MSCI Party shall have any liability for any errors or omissions in connection with any Information herein, or any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.