Unlocking value across a growing opportunity set through active management and the alignment of interests

Private equity (“PE”) has emerged as a significant force in global finance, offering investors unique opportunities for returns, diversification, and value creation that differ markedly from the public equity markets. As both institutional and individual investors seek alternative sources of investment return and resilience through cycles, private equity’s benefits are becoming increasing apparent to potential investors. This section explores the major advantages of private equity investment.

Alignment of Interests and Strong Governance

One of the major advantages of private equity is the close alignment of interests between investors, managers, and other company stakeholders. In a typical PE structure, the fund managers, otherwise known as General Partners (“GPs”) invest significant personal capital alongside their underlying investors who are known as Limited Partners (“LPs”), ensuring that there is “skin in the game.” Additionally, GPs are usually entitled to “carried interest”, a share of the profit made on investment disposals, if the investment return exceeds a certain hurdle. These mechanisms align incentives with LPs, motivating GPs to maximise value creation.

Furthermore, private equity ownership brings robust governance mechanisms and an active approach to asset management. Unlike the often-fragmented shareholder bases in public companies, PE investors typically acquire majority or significant minority stakes, enabling them to assert real influence over strategic direction and operational improvements.

GPs are truly active managers working to develop, improve and transform companies. Their long-term investment horizons, extensive firm resources and deep industry expertise mean they are well equipped to do so . This contrasts with public equity markets, where investors may be more passive in their nature and may be inclined to make decisions on a shorter-term basis.

Growing Market and Opportunity Set in Private Companies

More high-growth firms are opting to remain private for longer, making private equity increasingly important for investors seeking emerging opportunities.

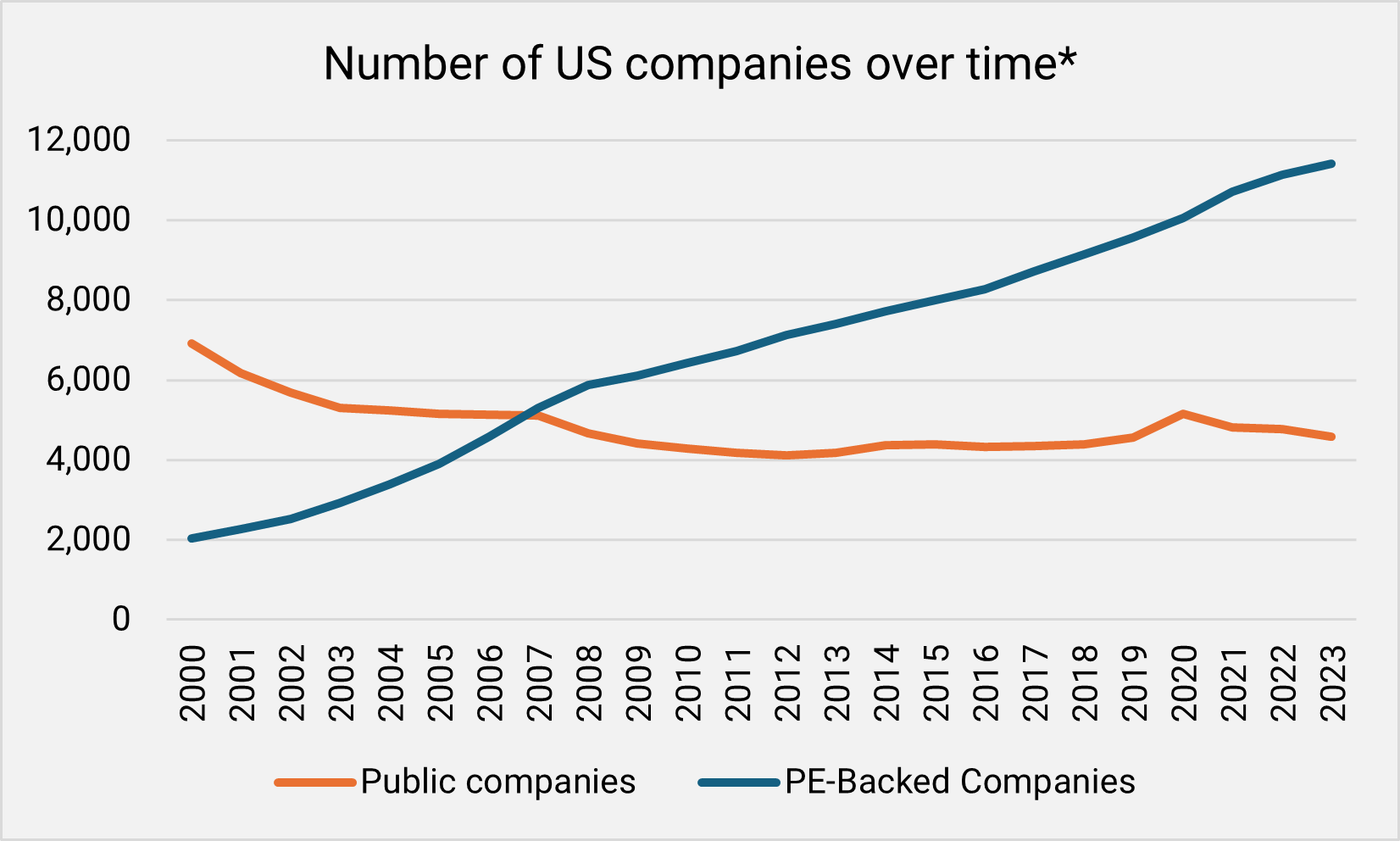

Morningstar indicates that a decade ago, private companies typically stayed private for 6.9 years; today, that figure has risen to 10.7 years1, contributing to a decline in public companies:

- The number of publicly traded US companies fell by 34% from 2000 to 20232.

- Meanwhile, the number of US private equity-backed companies grew by 459% over the same period3.

There are now 25 times more private than public companies*, many leading innovation in sectors like AI and space travel.

*As of June 30, 2024.

Source: Pitchbook. Private-equity-backed companies exclude venture capital.

Public companies are domestic US firms listed on the NYSE and Nasdaq. Past performance is not a reliable indicator of future results.

Outperformance of Public Markets

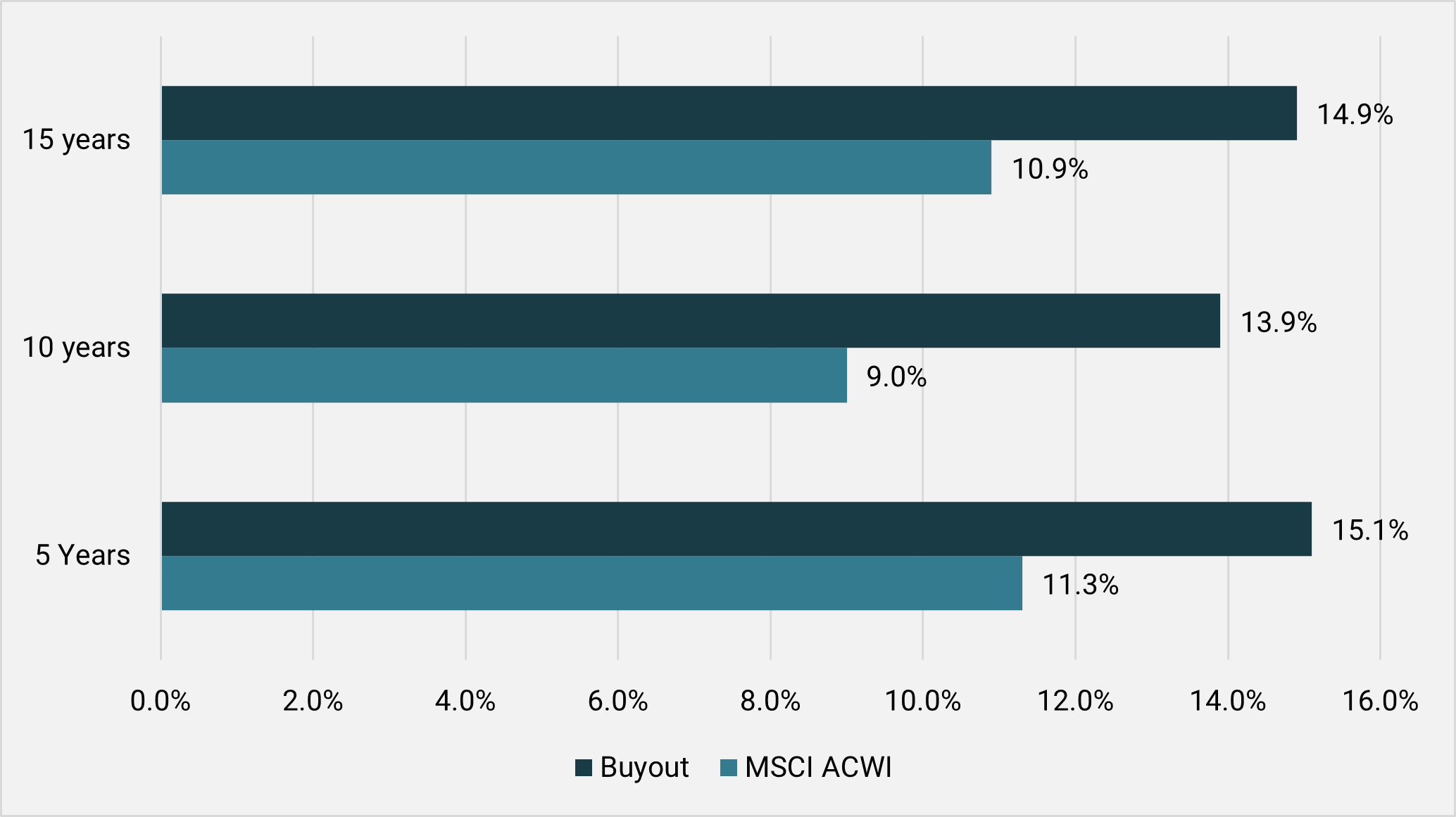

A core attraction of private equity is its historical ability to outperform public equities over the medium and long term. Additionally, this has been with a lower level of risk, with private equity returns typically being less volatile than listed equity returns.

Research by Harris, Jenkinson, and Kaplan (2014) found that US buyout funds outperformed public markets by 3-4% annually over a three-decade period. This outperformance or “alpha” is attributed to operational improvements, leverage, and more flexible capital structures, as well as the ability to identify and execute strategic value creation.

Time-weighted returns of private equity vs public equities4

Diversification Benefits

Private equity also offers significant portfolio diversification benefits. Because private equity investments are less correlated with public market movements, they can reduce overall portfolio volatility. This lower correlation stems from differences in valuation methodologies as private companies are not marked to market daily and from private equity’s focus on operational value creation rather than short-term price fluctuations.

Diversification is further enhanced by the global reach of private equity, with investors able to access opportunities across regions, industries, and company stages. Adding private equity to a traditional portfolio can improve risk-adjusted returns, particularly during periods of public market stress5.

To find out more about the benefits of diversification click here

Conclusion

Private equity investment offers a compelling mix of benefits: strong alignment of interests and active management, access to a growing universe of private companies, the potential for superior long-term performance, and valuable diversification. While private equity carries unique risks and requires careful manager selection, it remains an attractive allocation for investors seeking to enhance their portfolio’s returns and resilience in a rapidly evolving market.

Traditionally access to private equity investment has been limited to institutions and ultra-high net worth individuals, due to the high minimum commitment that general partners require limited partners to make to private equity funds. However, Investment companies such as HarbourVest Global Private Equity Limited (“HVPE”) democratise access to private equity assets by allowing investors to gain access to a global portfolio of private companies with a minimum investment of just one share.

You can find out how to invest in HVPE here: How to Invest in HVPE Shares | HVPE

You can find our more about Private equity and venture capital investment here: BVCA - Invested in a better future | Homepage

You can find out more about the wider benefits of private equity investment on the Invest Europe website here: About private equity | Invest Europe

Footnotes:

1 Data Source: Unicorns and the growth of private markets | Morningstar Indexes

2 Public companies are domestic US firms listed on the NYSE and Nasdaq.

3 Source: Data from www.Pitchbook.com as at 31 December 2023

4 Sources: MSCI Private Capital Solutions, S&P Capital IQ. All returns in USD. Past performance is not a reliable indicator of future results. All data as of 30 June 2024.

5 Cambridge Associates. (2023). Private Investing for Institutional Portfolios.

Disclaimers:

Note: The value of any investment made in the shares of HVPE and the income from any such investment can go down as well as up, and the investor may not get back the full amount invested. Past performance cannot be relied on as a guide to future performance.

Note 2: MSCI Private Capital Solutions (f.k.a. Burgiss Private Index Data) (unless otherwise indicated) reflects the fees, carried interest, and other expenses of the funds included in the benchmark. Please note that Fund returns would be reduced by the fees, carried interest, and other expenses borne by investors in the Fund. Such fees, carried interest, and other expenses may be higher or lower than those of the funds included in the benchmark. Certain information contained herein (the “Information”) is sourced from/copyright of MSCI Inc., MSCI ESG Research LLC, or their affiliates (“MSCI”), or information providers (together the “MSCI Parties”) and may have been used to calculate scores, signals, or other indicators. The Information is for internal use only and may not be reproduced or disseminated in whole or part without prior written permission. The Information may not be used for, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product, trading strategy, or index, nor should it be taken as an indication or guarantee of any future performance. Some funds may be based on or linked to MSCI indexes, and MSCI may be compensated based on the fund’s assets under management or other measures. MSCI has established an information barrier between index research and certain Information. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. The Information is provided “as is” and the user assumes the entire risk of any use it may make or permit to be made of the Information. No MSCI Party warrants or guarantees the originality, accuracy and/or completeness of the Information and each expressly disclaims all express or implied warranties. No MSCI Party shall have any liability for any errors or omissions in connection with any Information herein, or any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.